Transitory Inflation: What Does it Mean and Why Does it Matter?

September 14, 2021

If you’ve watched, listened to, or read any news at all lately, you’ve probably heard the term “transitory inflation.” It’s a hot topic amongst members of the Federal Reserve and various news outlets and it has been for a while—but why is this basic economic concept (that is, inflation) suddenly the talk of the town? There are a few reasons, but before we get into that, let’s review some terms.

At its core, inflation is the increase in the price of goods and services over time. We measure this increase (and occasional decrease) with the Consumer Price Index (CPI), a mathematical equation that estimates the average cost of a figurative “basket” of goods purchased by consumers. The goods and service categories that make up this imaginary basket are:

- Food & Beverages

- Housing

- Clothing

- Transportation/Gas

- Education & Communication

- Medical Care

- Recreation

- Other Goods & Services

Prices for items in each category are then averaged, and the sum of those averages makes up the CPI. The inflation rate is then measured by the percentage increase or decrease in the CPI over a certain period. The Core Consumer Price Index is a similar estimate for the cost of goods, but with food and energy (i.e., transportation) removed from the equation.

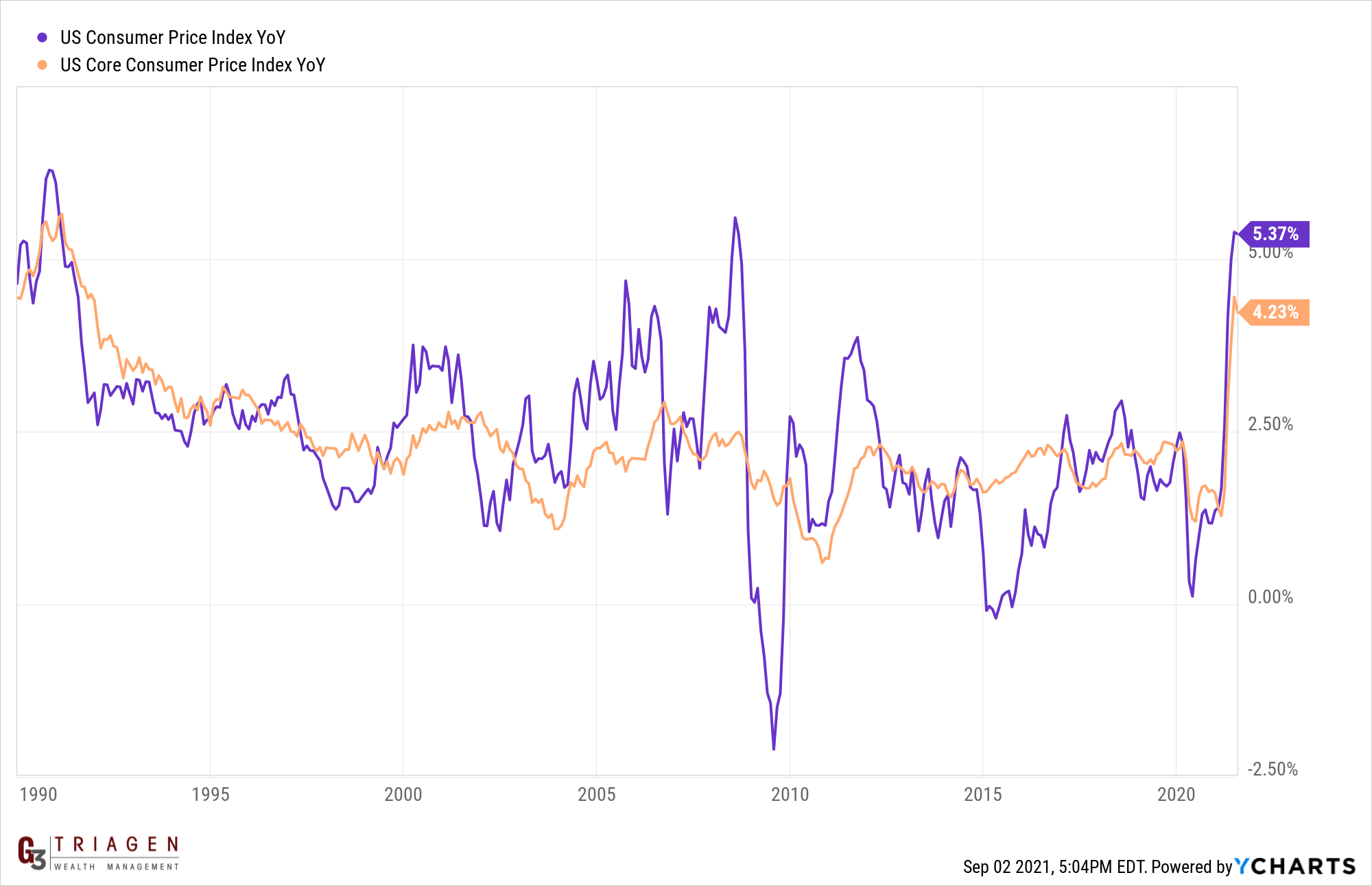

In general, prices tend to increase over time—which is no surprise if you’ve ever seen what a Big Mac cost at its inception or if you purchased a tank of gas in the 70s. What’s notable, though, is that we haven’t experienced significant inflation for the past few decades. In fact, since 1982 through last year, the inflation rate hovered around 2.5 percent. Compare that to the 1960s and 1970s when inflation rates were nearly double, averaging around 5 percent[1].

The primary reason for the lower inflation rates in the past few decades is the influx of technology and the globalization of products and services. We can manufacture products for less money, distribute them globally, and compete (or partner) with other countries for supplies. In addition, certain goods and services cost less to distribute because of technological advances (online schooling, for instance, decreases transportation costs and sometimes living expenses).

Why is Inflation So Important?

Inflation affects nearly every aspect of our financial ecosystem. If the economy were to experience stronger inflation, that would impact the purchasing power of the “almighty dollar.” To keep up with inflation or, said another way, to “preserve one’s purchasing power,” you would need to experience a positive “real return” on your investments. Real returns are what is earned on an investment after accounting for inflation.

What has most people talking (and investors worried) is that when inflation is high, “real returns” are lowered, and for some investments, could possibly be negative. If your earnings don’t keep up with inflation, you lose money in the long run.

So Why is Everybody Talking About Inflation Now?

Recently, we’ve seen a dramatic increase in inflation rates. That’s because we’re comparing the CPI in 2021 to the CPI in 2020—a year when the entire world essentially shut down, causing inordinately low demand (except, that is, for toilet paper) and almost no travel. Now, with the world opening and demand increasing, we’re experiencing shortages and consequently inflated prices. Globalization improved our access to goods before, but now that much of our manufacturing is international, we’re experiencing supply-chain issues on a global scale. Semiconductors are in short supply and car manufacturers are struggling to meet demand, so now even used vehicles are being sold at inflated prices[2].

With all these factors in play, our year-over-year inflation rate is currently between 4 and 5 percent—a significant and notable jump from the 1 – 1.5 percent of the past several years. (To put that in perspective with your investments, that means if you’re not earning more than 5 percent, you’re losing money in “real” terms.) But remember—while prices of goods have increased, this higher inflation rate is said to be transitory, or temporary. Which brings me to my next point…

What Makes This Spike Transitory?

One thing to note is that “transitory inflation” doesn’t refer to a temporary price increase (since, in general, prices will continue to increase). Instead, it refers to the temporary high rate of inflation. Many people (including federal officials) predict that inflation rates will soon return to normal (or at least, what we’ve come to view as normal in the last 30 years).

The Fed predicts that as global supply chains come back online and semiconductors return to the market, “normal” inflation rates will also return. In a few months, we’ll be able to do another year-over-year comparison to a time in our economic history when we weren’t in the middle of a global pandemic, and the inflation rate at that point should be closer to 1.5 or 2 percent. So, 2020 abnormalities aside, there aren’t many reasons we should continue to experience low supply and high demand—or an inflation rate between 4 and 5 percent.

Should I Be Concerned About Transitory Inflation?

If inflation rates do level off as predicted, there’s not much to worry about. But if the trend continues, the Federal Reserve might employ strategies to lower the inflation rate closer to 2 percent. And typically, they attempt to do that by raising interest rates.

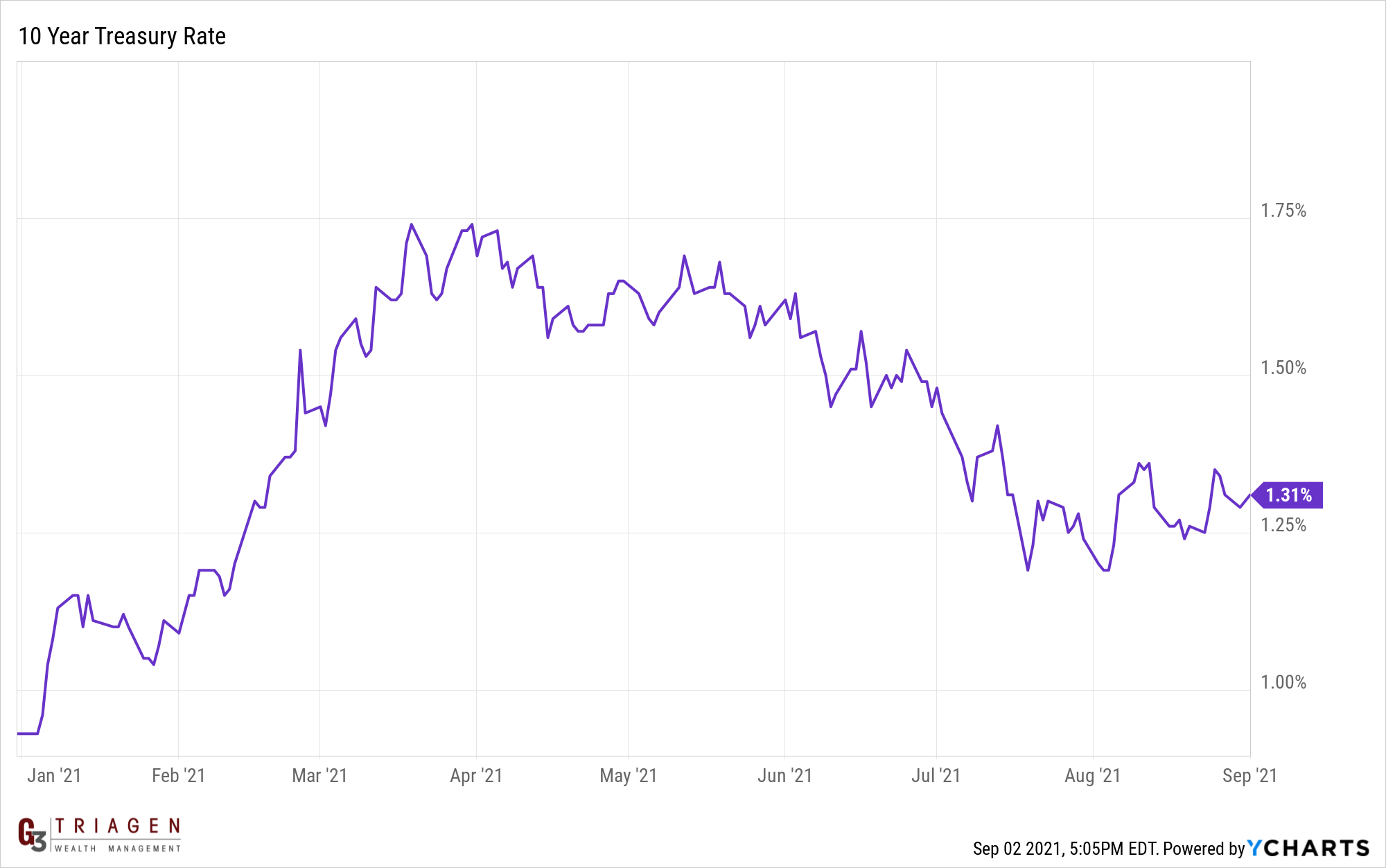

Monetary policy changes (the Fed raising rates) are also a cause of angst for investors. An increase in interest rates may impact the stock market (as higher interest rates can lead to lower valuations) and are a larger concern for bondholders. Bond prices move inversely to yields, which creates a headwind for bonds if the Fed starts raising interest rates. If you currently own a bond yielding 1.5%, then in addition to a negative real return, an increase in interest rates above that level will lower the price of your bond.

With the possibility of negative real returns and headwinds of rising interest rates, some bond holders feel pressured to pivot their investment strategy to other, potentially riskier asset classes (like stocks). Ultimately, it’s better to stick with your original investment plan that’s aligned with your risk tolerance—otherwise you put yourself at unnecessary risk for losses later, when you might not be able to afford them.

Another issue with this “transitory inflation” is that it could turn into a self-fulfilling prophecy. If price increases persist for longer than expected, people might fear it will never level off—and when that happens, it’s likely people will start stockpiling, purchasing items sooner than needed in anticipation of further price increases. And of course, the more people stockpile, the greater the demand, and the more prices continue to inflate (see: “Coronavirus, toilet paper”).

What Can I Do to Protect My Portfolio?

One of the most important things you can do is keep a level head. Sure, transitory inflation sounds like a big deal and it’s producing real consequences—but it’s likely that most of the changes we’re seeing will level out eventually, especially if people avoid the temptation to act out of fear.

The conversation also changes daily, which is why your financial strategies should be based on long-term generalities rather than day-to-day fluctuations in the market. Just look at the past year—in April 2021, the 10-year treasury was at 1.75 percent and economists predicted it would climb to 2 percent—but during the summer, interest rates dropped to 1.25 percent, then 1.18. Consequently, the current bond market doesn’t look like that of an inflationary environment at all, but one of slower growth. You can’t make decisions based on what’s happening today because tomorrow it’ll probably change.

That’s why when we design your portfolio, we take unexpected circumstances like this into account. It’s also why we encourage you to diversify your assets—someone who invested only in bonds might be in a tough spot soon (and have overall low returns, inflation consequences aside), while someone eschewing bonds for an all-stock portfolio might not be able to handle the volatility of such an aggressive portfolio—and consequently make poor decisions (like selling when the market is down).

This is why we think it’s important to have a “goals-based” strategy that’s consistent with your unique needs and risk tolerance. In your early accumulation years, you can afford to be more aggressive with investments because you have more time to recover losses; the opposite is true as you get closer to and into retirement. You don’t need to drastically alter your strategy just because the economy has changed—that’s the point of a balanced portfolio. Stock returns help you grow your assets more effectively, as they tend to outpace inflation, while bonds tend to hold up when the stock market isn’t performing well. They’re both important, and we want to make sure you’re in a position to achieve your goals in the most effective way possible—no matter what the headlines are saying.

Of course, past performance does not guarantee future results. There is no guarantee a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

[1] https://www.in2013dollars.com/1960-dollars-in-1990

[2] Semiconductors are, to put it very simply, pieces of material that only partially conduct electricity and are vital contributors to technological advancements like cars, phones, and computers.