Strategic Allocation

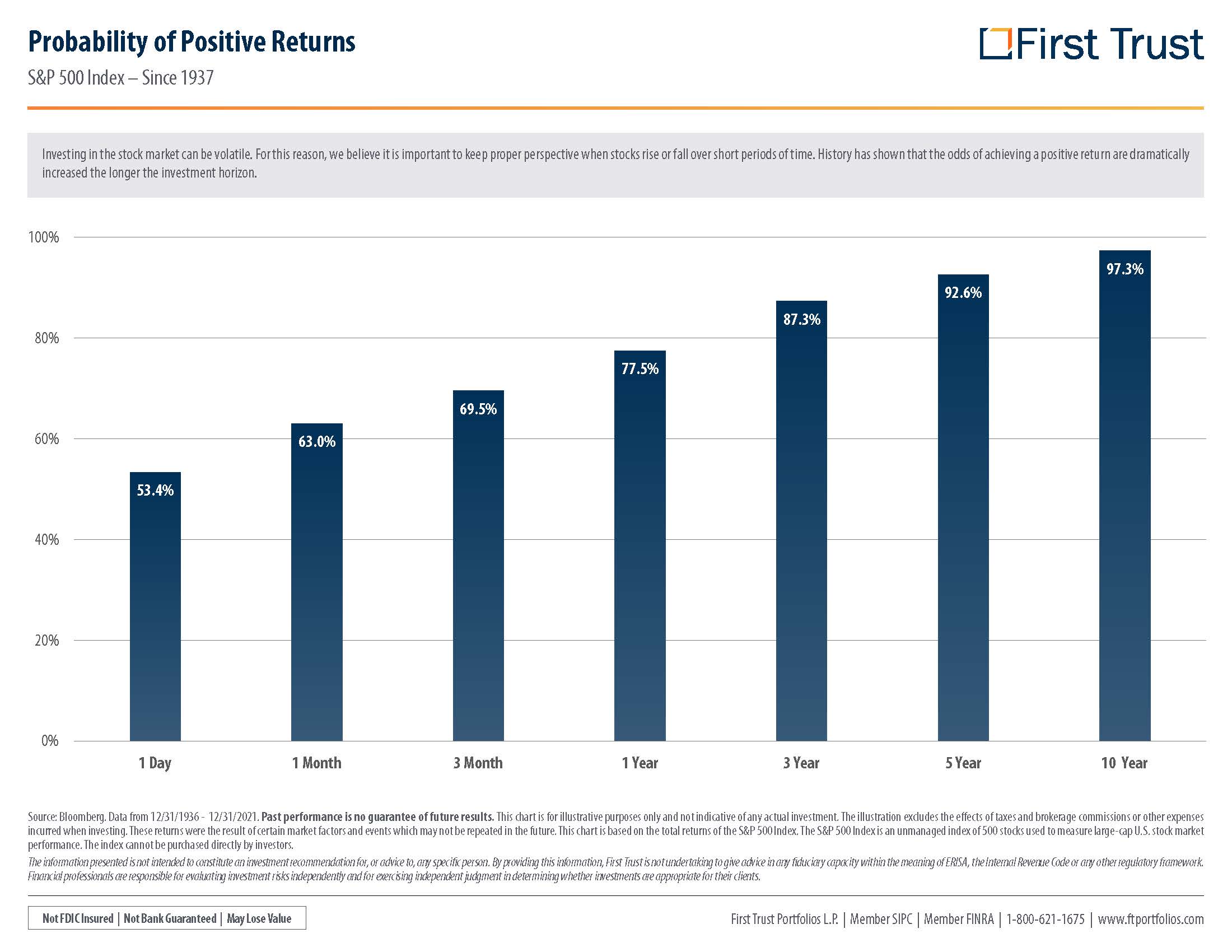

After identifying our cash and bond buckets, we can now focus on the growth allocation of the portfolio. A quick Google search of “Active vs. Passive Investing” yields 18,900,000 search results! We don’t believe we need to put ourselves in one camp or the other. We believe in building a portfolio using a combination of indexed strategies and actively managed strategies. We start with a “strategic allocation” in a global equity portfolio using a broad range of asset classes. We make subtle shifts in the allocation as warranted but this portfolio is always fully invested and holdings don’t change very often as we rely heavily on our belief #1. We call this buy and hold portfolio our “Core” equity portfolio.

Tactical Allocation

In addition to the Core portfolio that uses a strategic allocation, we manage several strategies that use a tactical allocation approach. We believe the tactical allocation addresses our core beliefs by flipping them around:

- Core Belief #3 – In order to have good investment behavior, you need to be able to emotionally handle the tough times

- Core Belief #2 – Knowing that there is ALWAYS the possibility of Short-Term Volatility that could lead to poor investment behavior, we want to have a game plan to address the short-term volatility

- Core Belief #1 – having a game plan in place to address the short-term volatility allows us to stick with Core Belief #1 that equity markets provide the best real returns over the long term

Our tactical strategies are governed by evidence-based factors that we believe complement the Core portfolio. We use a rules-based approach and technical analysis when applying these factors (e.g. – momentum and relative strength). Our tactical portfolios fall into two broad categories:

Growth with Risk Management

Warren Buffet once said “The first rule of investment is: Don’t Lose. And the second rule of investment is: Don’t forget the first rule.”

We manage various strategies that attempt to mitigate the reality of core belief #2 by using “stop losses”. Even with the use of stop losses our portfolios will fully participate in the early stages of a broad market decline. The reason for using stop losses is to attempt to limit the amount of downside risk we have during a prolonged market decline.

Momentum

We’ve all heard the saying “buy low, sell high”, yet studies have shown that momentum (the tendency for winning stocks to continue performing well in the near term) has been one of the stronger generators of returns. We use a variety of different technical indicators to identify positive momentum.

By combining our core strategy with our tactical strategies, we believe we offer a growth portfolio that may 1. Produce real wealth over time 2. Respect the volatility of the markets and 3. Allow us to ‘stick with’ an investment portfolio that will help breed good investment behavior.