40,000 and Beyond: Lessons from the Dow for Long-Term Investors

May 30, 2024

On May 16, 2024, the Dow Jones Industrial Average reached a milestone of 40,000. This is a significant achievement for the stock market and evidence of the power of long-term investing.

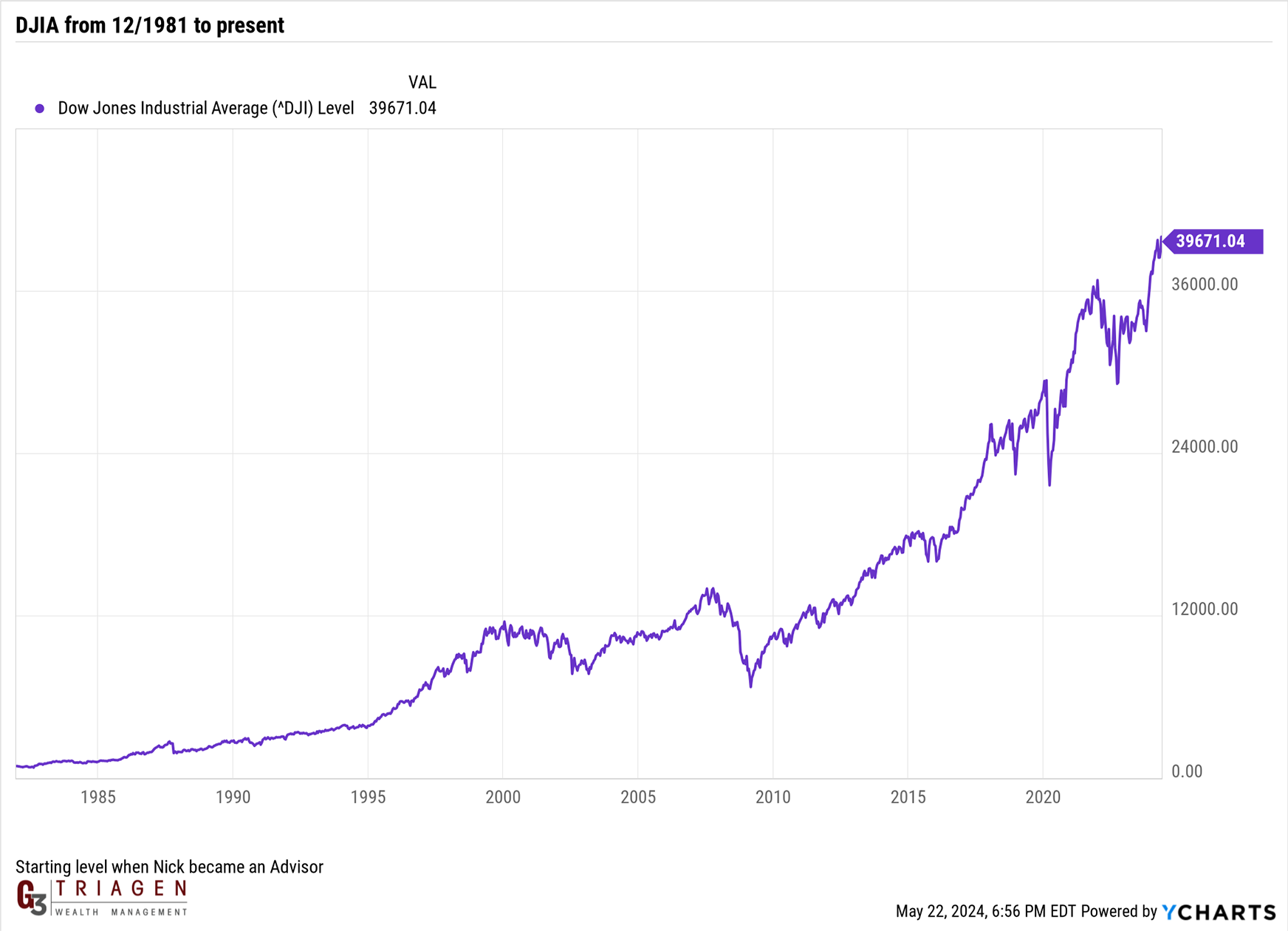

Nick, one of our founding partners, was licensed in December 1981 when the Dow was at 875. At that time, a book titled Dow 3,000 predicted the index would hit 3,000, which seemed overly optimistic. Just 17 years later, another book, Dow 40,000, forecasted the Dow would reach 40,000 by 2016. Despite the skepticism, the Dow has now surpassed that mark, demonstrating a remarkable growth trajectory.

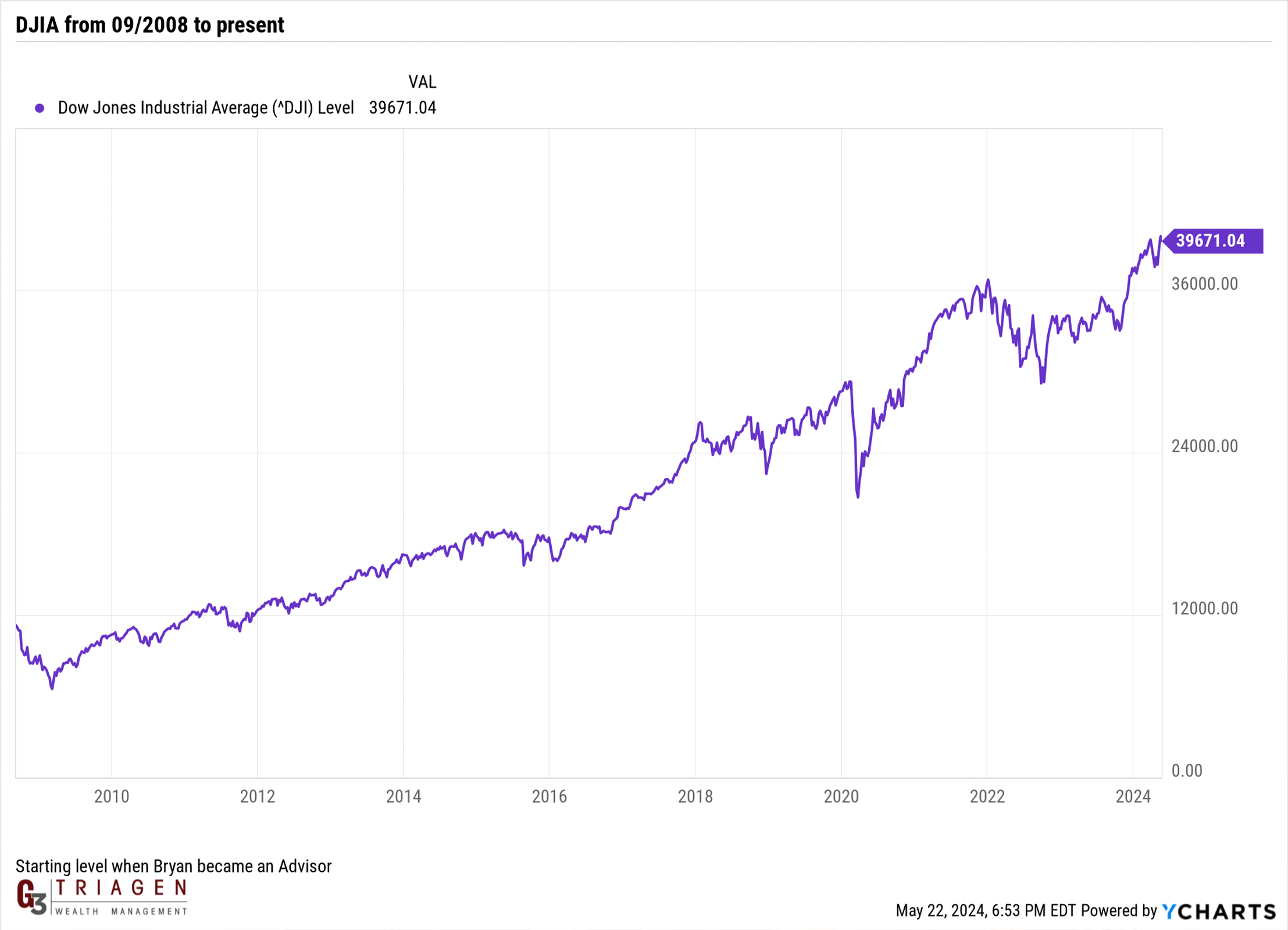

Since 1981, the Dow has grown from 875 to 40,000, translating to a 4,700% return. To put that in perspective, if you had invested $10,000 back then, it would be worth $470,000 today. Even more recently, since 2008 when our managing partner Bryan was licensed, the Dow has increased by almost 30,000 points from around 11,395 at that time. These milestones highlight the importance of being invested over the long term and the extraordinary power of compound returns.

The Power of Long-Term Investing

The growth of the Dow over the decades shows the importance of staying invested and maintaining a long-term perspective. Compound returns, where you reinvest your earnings to earn even more, are a key principle of building wealth. The longer you stay invested, the more your money can grow, often at an accelerating rate.

Is the Dow a Good Measure of the Market?

Although the Dow is the most well-known index, it doesn’t perfectly represent the entire market. The Dow only includes 30 stocks, while the entire market includes around 3,000. However, the Dow does represent a wide range of industries, including industrial, energy, retail, and more, giving a broad view of the economy’s performance.

One major drawback of the Dow is that it is price-weighted. This means stocks with higher prices have a bigger impact on the index than those with lower prices. For example, United Health (UNH) makes up 8% of the Dow due to its high stock price, compared to only about 1% in the S&P 500, which is market cap-weighted.

Additionally, the Dow doesn’t account for reinvested dividends, which can make its total return appear lower compared to indices like the S&P 500 that do include them. Even with this limitation, the Dow’s long history still gives us valuable insights into the growth and strength of the stock market.

Long-Term Strategies for Success

With the Dow hitting 40,000, some investors might wonder if they should change their investment strategies. At TriaGen, we emphasize the importance of focusing on long-term strategies, adhering to fundamental investment principles, and avoiding market timing. History has shown that disciplined, long-term investing leads to substantial returns.

Here are some key principles to guide your investment strategy:

- Invest for the long term: Focus on long-term goals rather than short-term market fluctuations.

- Diversify your portfolio: Spread your investments across various asset classes to mitigate risk.

- Avoid market timing: Trying to predict market movements is risky and often counterproductive. Instead, think about using dollar-cost averaging. This approach involves investing a fixed amount of money regularly, no matter the asset’s price.

- Stay emotionally disciplined: Avoid panic selling during market downturns.

If you have questions about your investment strategy or want to discuss how you can benefit from long-term investing, we’d love to chat with you. Schedule a consultation with us or give us a call today.