Small-Cap Stocks: The Underdog Heroes of Market Rotations

August 5, 2024

Investing is all about diversification—spreading investments across different asset classes to balance performance and maximize growth opportunities. For the past 14 years, large-cap U.S. stocks have dominated the market, leading some investors to question the value of holding other types of stocks, like small-caps.

What are small-cap stocks?

Small-cap stocks represent companies with a market value between $250 million and $2 billion. Market capitalization is calculated by multiplying the current stock price by the number of outstanding shares. These companies typically have market capitalization because they are still in the growth phase. Small cap stocks usually belong to newer or younger companies, offering great growth potential but also carrying higher risks.

Why invest in small-cap stocks?

Small-cap stocks have historically outperformed for a few key reasons:

- Growth Potential: Smaller companies have more room to grow and can adapt quickly, unlike larger, slower-moving companies. This agility helps small-caps seize new opportunities and expand rapidly.

- Market Inefficiencies: Small-cap stocks are often under-researched and not as well understood by investors, providing opportunities for savvy investors to find hidden gems. The lack of extensive analyst coverage can lead to mispricing, offering potential for higher returns.

- Higher Risk, Higher Reward: Because small-cap stocks come with higher risk, investors demand higher returns. This risk/return trade-off is a fundamental part of investing in small-caps.

These reasons are why we allocate a portion of our portfolio to small-cap stocks, despite their recent underperformance.

Current Market Performance

Since January 2023, large growth in tech stocks has dominated the market.

Over the past 18 months, we’ve seen the S&P 500, which tracks the 500 biggest U.S. companies, soar by 46%. Meanwhile, the Russell 2000, which focuses on smaller, up-and-coming firms, has only grown by 18%. This 28% difference is quite striking—usually, large-caps outshine small-caps by a much smaller margin.

This significant performance gap has led many to focus solely on large-cap stocks. However, it’s important to consider the cyclical nature of markets and recognize that small-cap stocks can also present valuable opportunities under different conditions.

Recent Market Rotation

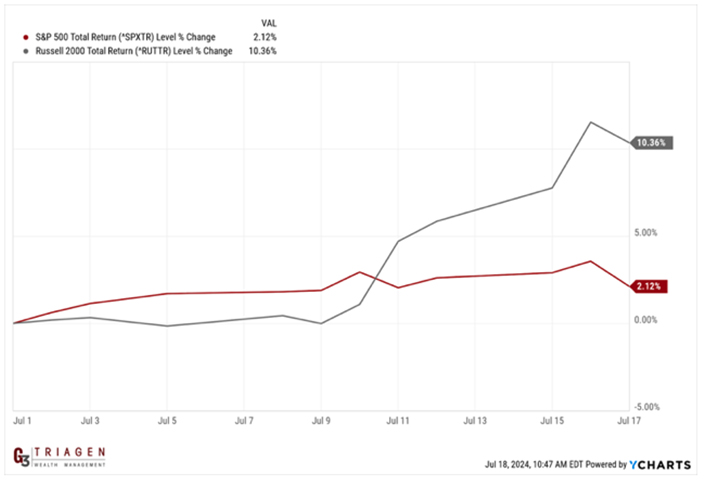

In the last ten trading days (as of July 17, 2024), we’ve seen a surprising rotation: the Russell 2000 is up by 10-11%, while the S&P 500 is up by just 2%.

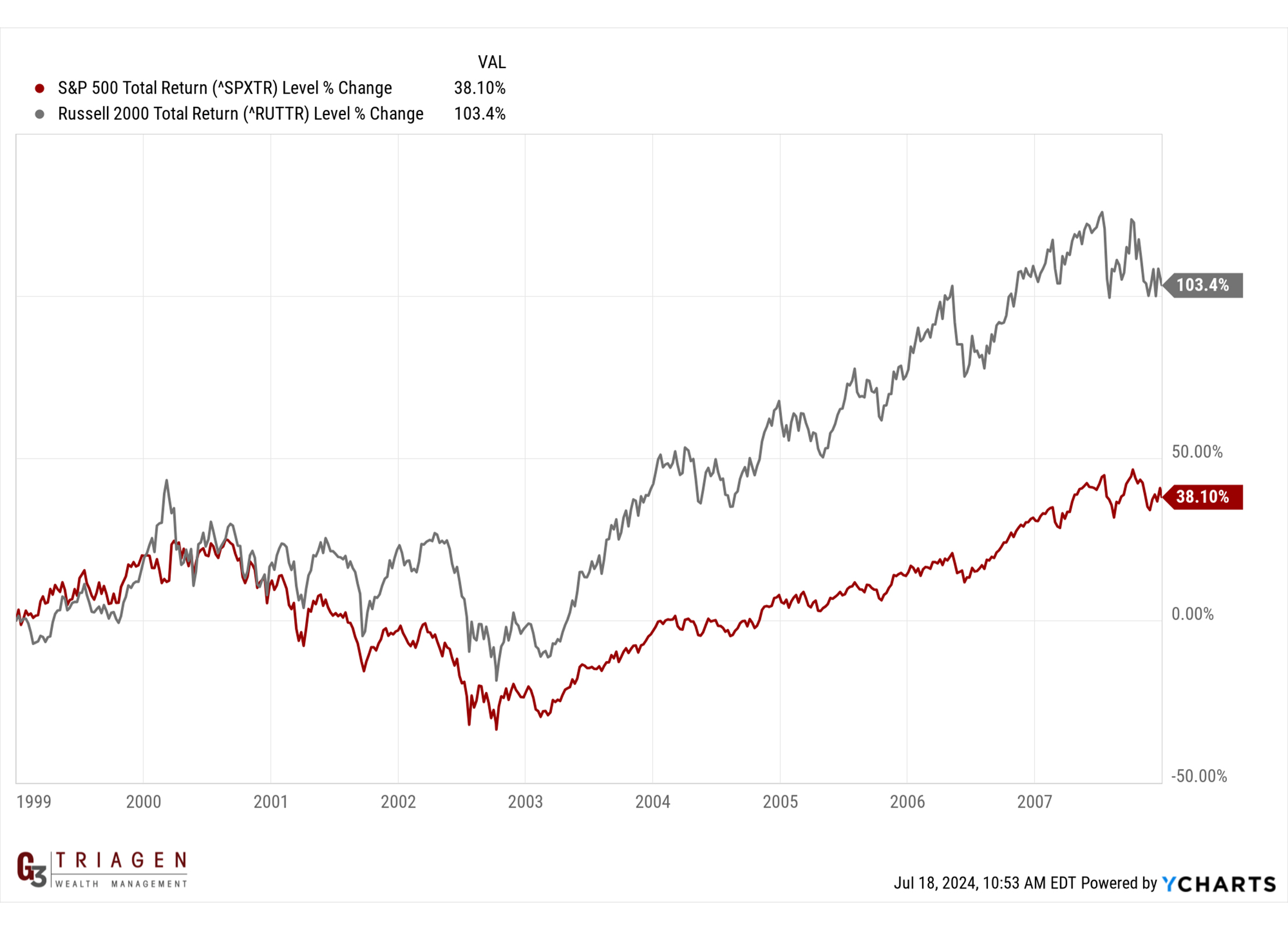

Although two weeks doesn’t confirm a long-term trend, it hints at a potential shift towards small-cap stocks. This rotation is reminiscent of the period from 1999 to 2007 when small-caps significantly outperformed large-caps.

During this time, small-cap stocks were up 103%, while the S&P 500 rose by only 38%.

Historical Context and Potential Comeback

Small-cap stocks have a history of shining brightly over decades. Even though they come with higher risks, their potential for big returns makes them an important piece of a well-rounded portfolio. The recent underperformance might just be the calm before a turnaround, as we’ve seen before. For example, in the late 1990s, large-cap tech stocks were all the rage, much like today. But from 1999 to 2007, small-caps took the spotlight, showing how market leadership can shift over time.

Marco Factors Influencing Small-Cap Stocks

Several macroeconomic factors could support a small-cap comeback:

- Inflation: Signs of decreasing inflation are generally positive for small-cap stocks.

- Federal Reserve Policies: Potential lowering of interest rates would benefit small-cap companies that rely on debt and have lower cash reserves. If interest rates drop, operating costs for these companies will decrease, potentially boosting their performance.

We can’t predict the future, but spreading our investments across different asset classes helps us tap into all kinds of growth opportunities. With the recent market shift, small-cap stocks might be ready for a rebound. That’s why we include them in our portfolios alongside high-performing large-caps, ensuring a well-rounded and strategic approach to growth.

There will always be investors who ask, “Why not just invest in whatever is performing well?” The answer lies in diversification—by spreading your investments across various asset classes, you gain access to all potential growth opportunities and balance your risk.

We’d love to chat with you more about your investment strategy. Schedule a consultation with us or give us a call today.

Diversification cannot ensure a profit or protect against loss in a declining market. It is a strategy used to help mitigate risk.